U.S. Stock Market Sector Winners: Technology, Consumer Discretionary, and Financials Outshine Healthcare

The U.S. stock market in April 2025 has shown notable sectoral shifts, with some industries leading the charge while others lag behind. Consumer Discretionary, Information Technology, Financials, and Communications sectors have delivered strong gains, whereas Healthcare has experienced a noticeable slowdown. This article provides a comprehensive analysis of the top-performing sectors, the underlying factors driving their success, and highlights the standout stocks that have shaped recent market momentum.

1. Leading Sectors Driving Market Growth

Consumer Discretionary: Powered by Digital Consumption and Strong Demand

The Consumer Discretionary sector, encompassing non-essential goods and services, has been one of the strongest performers. Growth has been fueled by robust consumer spending, especially in e-commerce, automotive, and leisure industries.

- Key Drivers:

- Continued expansion of online retail and digital services.

- Seasonal tailwinds, with April historically a strong month for this sector.

- Solid earnings reports from major players.

- Notable Stocks:

- Amazon (AMZN), benefiting from sustained growth in online sales.

- Tesla (TSLA), with strong electric vehicle demand and innovation.

Information Technology & Technology: The Innovation Powerhouse

Technology and Information Technology sectors remain at the forefront of the market rebound. Demand for artificial intelligence, cloud computing, and semiconductors has propelled these sectors to new heights.

- Key Drivers:

- Widespread adoption of digital transformation technologies.

- Recovery and growth in semiconductor manufacturing.

- Positive earnings surprises from tech giants.

- Notable Stocks:

- Nvidia (NVDA), a leader in AI chip development.

- Microsoft (MSFT), expanding its cloud and enterprise services.

- Apple (AAPL), supported by strong product sales and services revenue.

Financials: Benefiting from a Favorable Interest Rate Environment

The Financials sector has performed well, aided by rising interest rates that boost banks’ net interest margins and solid earnings reports.

- Key Drivers:

- Increasing interest rates improving profitability.

- Strong quarterly results from leading financial institutions.

- Stable macroeconomic conditions supporting lending growth.

- Notable Stocks:

- JPMorgan Chase (JPM), a consistent outperformer.

- Goldman Sachs (GS), benefiting from robust trading and advisory activity.

Communications: Growth Fueled by Digital Engagement

The Communications sector, which includes media, telecom, and internet companies, has seen strong gains driven by increased digital consumption and advertising revenues.

- Key Drivers:

- Growth in streaming services and 5G network expansion.

- Recovery in digital advertising budgets.

- Rising demand for mobile and internet services.

- Notable Stocks:

- Alphabet (GOOGL), a dominant player in digital ads and cloud.

- Meta Platforms (META), benefiting from social media engagement.

2. Healthcare Sector: Facing Headwinds

In contrast, the Healthcare sector has underperformed, marking its longest period of relative weakness in decades. This downturn is largely due to political uncertainty, regulatory concerns, and pressure on drug pricing.

- Key Challenges:

- Political and regulatory uncertainty affecting investor confidence.

- Ongoing debates over pharmaceutical pricing and reimbursement.

- Temporary slowdown in elective medical procedures and innovation pipelines.

- Notable Stocks:

- Pfizer (PFE), impacted by declining COVID-19 vaccine revenues.

- UnitedHealth Group (UNH), facing regulatory and margin pressures.

Despite recent struggles, many analysts believe Healthcare is poised for a rebound, supported by demographic trends and ongoing innovation.

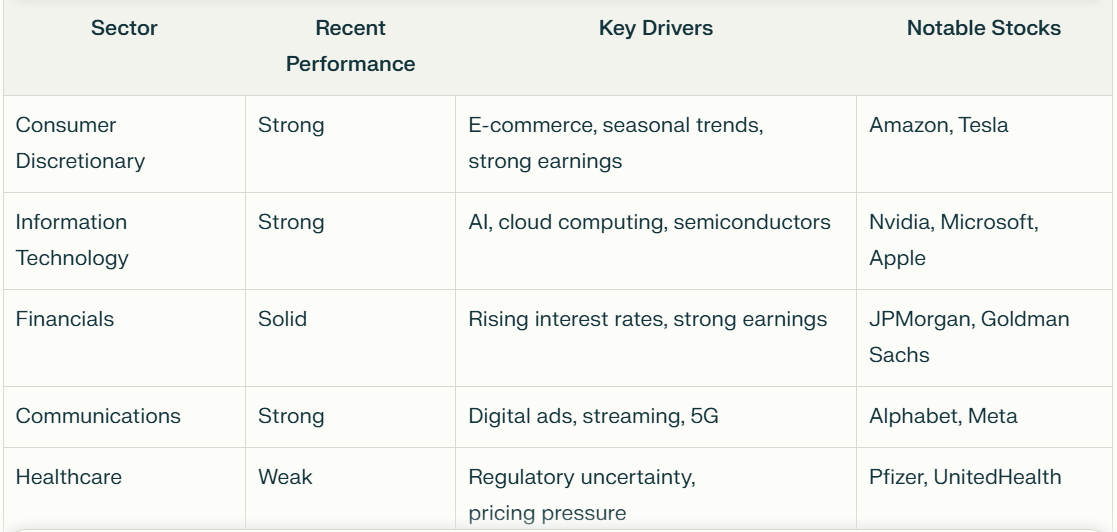

3. Sector Performance Summary

4. What’s Behind the Sector Rotation?

Several factors are driving the rotation observed this month:

- Interest Rates: Rising rates favor Financials while impacting growth sectors.

- Consumer Trends: Shift toward digital consumption boosts tech and discretionary sectors.

- Regulatory Environment: Healthcare remains sensitive to political developments.

- Earnings Season: Strong quarterly results fuel rallies in leading sectors.

5. Investment Outlook and Strategy

Sector rotation is likely to continue as economic data, central bank policies, and geopolitical factors evolve. While the leading sectors offer growth opportunities, Healthcare’s current weakness may present value opportunities for long-term investors.

- Diversify: Maintain balanced exposure across sectors to manage risk.

- Focus on Innovation: Prioritize companies driving technological and medical advancements.

- Monitor Regulatory Changes: Stay alert to policy shifts, especially in Healthcare.

- Risk Management: Adjust portfolios to navigate ongoing volatility.

6. Conclusion

April 2025 highlights the dynamic nature of sector performance in the U.S. stock market. Consumer Discretionary, Technology, Financials, and Communications have led the gains, supported by strong fundamentals and favorable trends. Meanwhile, Healthcare has faced challenges but remains a sector with significant long-term potential.